An Entitlement is the condition of having a right to have, do, or get something the feeling or belief that you deserve to be given something (such as special privileges) or a government ‘entitlement’ program that guarantees and provides benefits to a particular group.

The rise of the labor movement and the Socialist Party in the 1930s and the late 1940s, brought forth the current social programs, which the media and the government now call ‘entitlements’.

These were won by economic and political action independent of the ruling class. Right now, the ruling class wants to plunder and end these funds.

What is missing from the whole “financial cliff’ debate is that workers earn their benefits! If one does not work, money is not deducted from their pay to purchase Social Security or Medicare Benefits. If we do not work we do not pay into the funds. Most workers pay more into these funds than they will ever live to collect.

Since 196, when LBJ and the Democratic Party, to balance the budget during the Vietnam War social security funds were put into the Federal Budget.The Feds have been systematically ‘borrowing’ (plundering), our money, to fund the wars in order to establish a ‘New World Order’ ever since. I put ‘borrowing’ in quotes, for they have been taking our money with no intention of paying it back. What they took from these social funds is what they call ‘our’ debt.

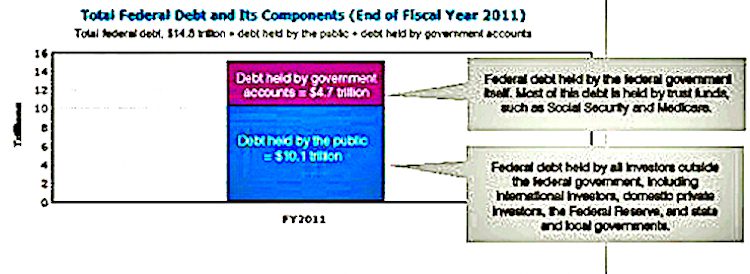

But it is owed us. According to Federal Debt Basics, $4.8 Trillion is currently owed to Social Security, Medicare, and other such funds — In reality it is owed to us! And $10.1 trillion is owed to the world’s 1% (Interest payments etc..).

From: Is Our Debt Burden Really $100 Trillion?:

The U.S. national debt comes out to about $16 trillion today. That’s something. But it’s nothing compared to the extra $87 trillion in unfunded liabilities to Social Security, Medicare, and federal pensions. Here’s how that works. If you add up all of the U.S. government’s promises to pay retirement and health care benefits for the next 75 years and subtract the projected tax revenue dedicated to those programs over the next 75 years, there is a gap. A $87 trillion gap – in addition to a $16 billion hole. Why haven’t Americans heard about the titanic $86.8 trillion liability from these programs?” Chris Box and Bill Archer ask in the Wall Street Journal. The authors blame the U.S. government for using shoddy accounting and for misleading the American public on their finances. In fact, the most misleading thing about that $87 trillion is the way the figure is often used in the media.

(1) That’s not our debt. Our $16 trillion in debt and our $87 trillion in “unfunded liabilities” represent two very different ideas: real past promises and projected future promises. Real past promises are, well, very real. We have to pay back our debt. Failing to do it would be an illegal and disastrous default. Unfunded liabilities are future promises, and, since they’re not as real, we can change them whenever we want without destroying ourselves. For example, raising the taxable income ceiling and slowing the growth of benefits could reduce the Social Security gap to zero tomorrow.

And that’s if there is a Social Security “gap” to begin with. Technically, it’s not legal for Social Security to have “unfunded liabilities” since it can only pay as many benefits as it receives in earmarked taxes. Both it and Medicare hospital insurance are prohibited from spending money they haven’t collected from specific revenue dedicated to their programs (i.e.: payroll taxes). It is impossible for either to technically be “unfunded”, since they cannot legally outspend their funding.

If the Federal Government can bailout the 1% to the tune of $29.616 Trillion Dollars, it can afford to pay back what it owes our funds! And tax the 1% for their wars!